Our Story

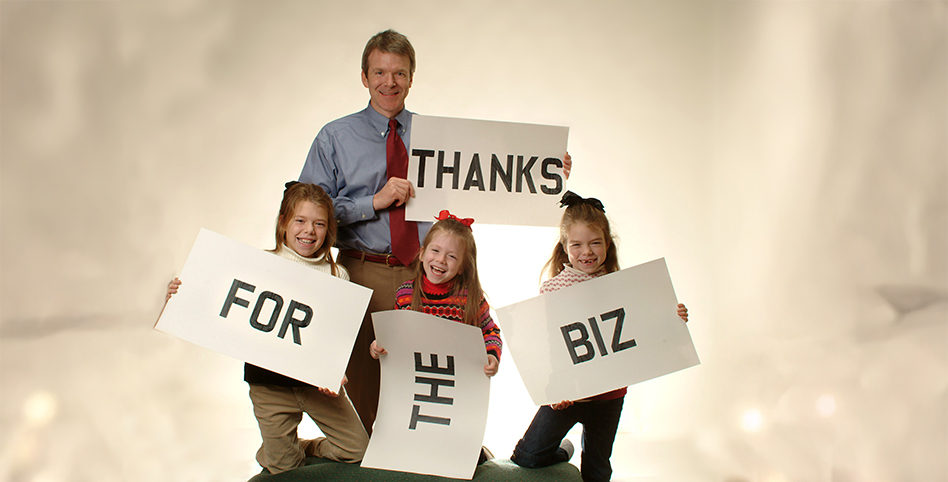

Carolina Home Mortgage opened in 2000 as a small family-owned business. Now serving all of North and South Carolina, we still keep it small, local, and easy-to-reach. We are a mortgage broker. We don’t lend you the money directly. Instead, we represent multiple lenders and look for the best mortgage to meet your financial needs. In operation since 2000, we rely on our loyal borrowers and those who want to call the Carolinas home.

Using a mortgage broker can be helpful because they know about many different loan options and can often find better deals than you might find by yourself. We invite you to compare us to your bank. Our commission is usually paid by the lender.